What to Do If You are Missing Tax Paperwork

Amherst, NH Resident Worries

While employers and institutions have a deadline for sending out tax paperwork, there are plenty of reasons it may fail to get into your hands. Whether lost in the mail, misplaced or some other event, the best step is to contact the issuer of the document. They may be able to send a duplicate copy right away. If you are still not having any luck getting the missing document, you can call the IRS. Providing information to the IRS about the document in question will make sure that you are covered when you go to file your taxes.

A resident in Amherst was stunned to find that she had never received a W2 from her previous employer. Concerned, she contacted Merrimack Tax Associates for advice.

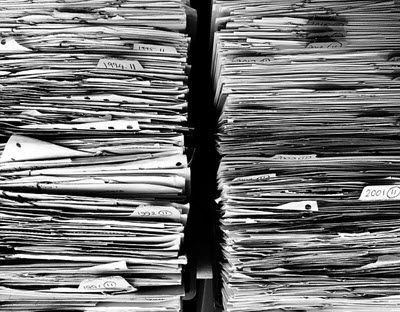

Double-Check Your Tax Documents

As you prepare your paperwork for tax season, it is a good idea to double-check to make sure everything is in your possession. This includes a W2 from any employers over the past year, home mortgage interest form 1098, student loan interest form 1089-E, government payments that include tax refunds and unemployment and investment income. If any of these documents are missing, they may be accessible online where you can print a copy yourself. If not, you can contact the employer or financial institution directly to request a copy.

When You Still Can’t Locate Your Tax Documents

If checking online and contacting the issuer has gotten you nowhere, you will want to contact the IRS about the dilemma. You will need to be ready to verify your identity with an IRS agent and the estimated wages or interest paid that would be in the missing document. The IRS can then contact the issuer, requesting the missing information.

When a W2 is missing and you have not been able to attain a copy, you can use Form 4852 as a replacement. Using this form and your last paycheck stub for the year, you can estimate wages and taxes paid.

The Amherst resident was able to get a copy of the tax document by contacting her previous employer. Armed with her paperwork now, the rest of her taxes should go smoothly.

business expenses, covid-19, irs, late taxes, missing paperwork, Self-Employed, tax deductions, Tax Filing Deadline, tax penalty, working from home