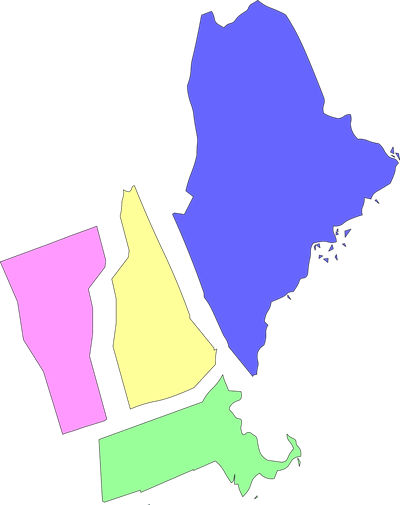

Hollis, NH Residents Wonders How New Job Will Affect Her Tax Filing

Living and working in different states can pose an interesting challenge when filing taxes. In most cases you will need to file multiple tax returns, a resident tax return for that state that you live in and a non-resident return for the state where you work. Filing two separate tax returns does not mean that you will have to pay two separate tax bills. On your resident state tax return you will report your tax liability from your non-resident tax return. All states allow filers to claim a tax credit based on taxes paid to other states.