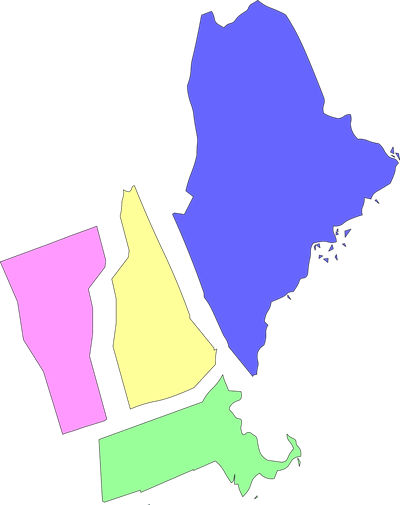

Hollis, NH Resident Seeks Help

The American Opportunity Tax Credit (AOTC) allows a maximum $2,500 per child per year for those paying for an undergraduate tuition. This credit can only be used for qualifying expenses that are not being paid with a 529 distribution. The Lifetime Learning Credit offers a maximum credit of up to $2,000. The Lifetime Learning Credit is not restricted to undergraduate study and can be used in graduate programs as well.