Are Your Tax Withholdings Accurate?

Brookline Resident Finds Out the Hard Way

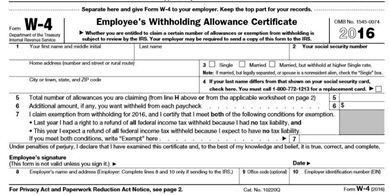

The amount of taxes withheld from your paycheck is a science, withhold too little and you get hit with a big tax bill. Too much and you miss out on extra cash throughout the year. For employees, the W-4 is what largely determines how much tax is held. Factors that may make you want to revisit your tax withholding include a change in marriage status, dependents, home ownership, or a change in your spouse’s employment.

A Brookline, NH resident learned the hard way that after a change in life your tax withholding may need to be adjusted. Much to his surprise, he was hit with a large tax bill for 2018.

Life Changes Can Mean a Big Change in Your Taxes

Filing jointly on your taxes with a spouse can affect your withholdings. For this reason, any time your marital status changes, whether through marriage or divorce, it is important to do a paycheck checkup. Similarly, the number of dependents that you have at home can affect your taxes.

Other factors that can affect the amount you pay in taxes include home ownership, particularly when you are paying interest on a mortgage which is tax-deductible. If you are married and filing jointly, your spouse’s income can affect your tax rate. If your spouse has a change in employment or receives a significant pay raise, it is worth revisiting your withholdings to ensure that your are paying in enough taxes each paycheck.

This Brookline resident met with the tax professionals at Merrimack Tax Associates, where we were able to recommend changes to his employer’s tax withholdings. Making these changes will ensure that he isn’t surprised when it comes time to file his 2019 tax return.